2BizBox® Manual |

Go back to 13.0 Main |

The Budget, as an important task of the enterprise’s financial management, also serves as an indispensable role in modern enterprise management. The budget management provided by 2BizBox contains a cash flow budget and a fiscal year budget. To realize the complete budget management of the enterprise, we recommend Serva Software LLC to do budget planning at the beginning of the year very carefully.

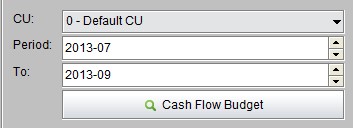

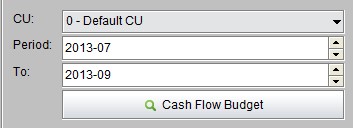

The Cash Flow Budget is calculated by the actual business that occurs in the Purchasing Box and Sales Box. It helps to complete the cash flow budget as well as examine the accounting cash flow statistics in different company units. Under the “General” tab of the Budget sub module, set a desired company unit and accounting period, then click “Cash Flow Budget” to open the Cash Flow Budget interface.

|

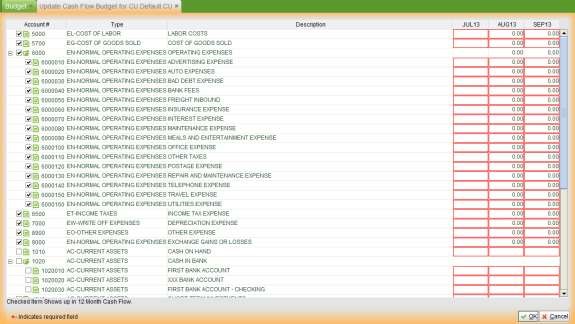

The past due SO, PO, AP, AR Prepay, AR and AP Prepay amounts are calculated by the accounting period that you selected. Click the “Update” button at the bottom left corner to open the editing interface and select accounts for the budget.

|

In the editing interface, check accounts from the left column, and fill in the budget for the accounts of the accounting period in the right columns. Budgets of sub accounts will be summed and included in the upper level accounts. When you finish, click “OK” to submit the budget.

|

The Fiscal Year Budget allows users to plan the entire fiscal year’s budget for all accounts of expense and cost by months. You can set the budget projects by account details and company centers. Click “Fiscal Year Budget” to open the fiscal year budget interface and click the “Update” button at the bottom left corner to edit detailed budget plans for each accounting period.

|

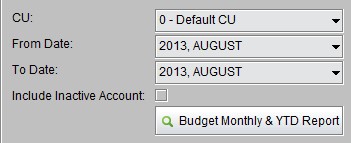

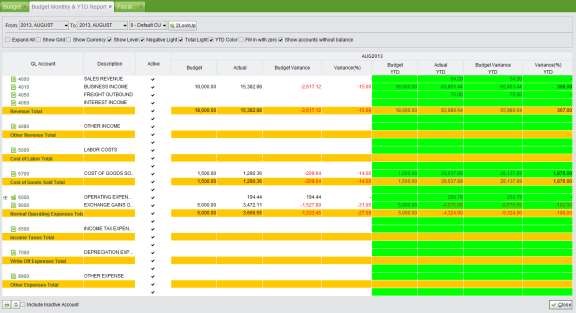

The Budget Monthly & YTD Reports show the variance between the budget amount and actual amount of the expenses, as well as the variance rate.

|

Select the Company Unit and accounting period, and click “Budget Monthly & YTD Report” to view the report.

|